The Single Strategy To Use For Small Business Accounting Service In Vancouver

Wiki Article

Some Of Tax Accountant In Vancouver, Bc

Table of ContentsA Biased View of Small Business Accounting Service In VancouverVirtual Cfo In Vancouver Can Be Fun For EveryoneGetting The Vancouver Tax Accounting Company To WorkA Biased View of Outsourced Cfo ServicesThe Main Principles Of Virtual Cfo In Vancouver The Main Principles Of Vancouver Accounting Firm

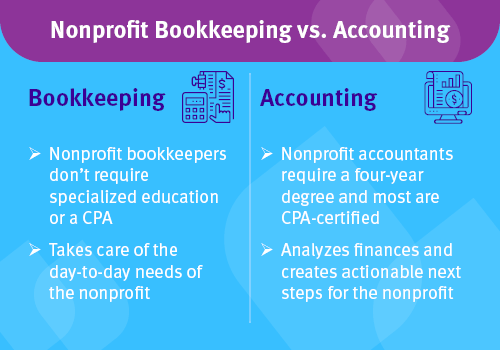

Right here are some benefits to employing an accountant over an accountant: An accountant can provide you a detailed sight of your company's financial state, along with methods as well as referrals for making economic choices. Accountants are just accountable for videotaping economic deals. Accounting professionals are needed to complete even more education, accreditations and job experience than accountants.

It can be challenging to determine the ideal time to employ an audit expert or accountant or to establish if you require one whatsoever. While many small companies employ an accounting professional as a professional, you have several choices for managing financial tasks. Some tiny service owners do their very own bookkeeping on software their accountant recommends or uses, providing it to the accounting professional on a regular, monthly or quarterly basis for action.

It might take some background research study to find a suitable accountant because, unlike accounting professionals, they are not required to hold an expert accreditation. A solid endorsement from a relied on colleague or years of experience are necessary aspects when hiring a bookkeeper. Are you still uncertain if you require to work with a person to aid with your publications? Below are three circumstances that suggest it's time to employ an economic specialist: If your tax obligations have actually come to be too complex to manage on your own, with multiple revenue streams, foreign financial investments, numerous deductions or various other factors to consider, it's time to employ an accountant.

See This Report on Virtual Cfo In Vancouver

:max_bytes(150000):strip_icc()/Accounting-software-4202206-primary-final-cd88d4c4a5cd40c6b848c793a6de496d.png)

For small companies, proficient cash money administration is a critical aspect of survival as well as growth, so it's wise to collaborate with an economic expert from the beginning. If you prefer to go it alone, think about beginning with accountancy software application as well as maintaining your books meticulously as much as day. In this way, must you need to hire a professional down the line, they will certainly have visibility right into the total monetary background of your service.

Some source interviews were conducted for a previous variation of this write-up.

An Unbiased View of Outsourced Cfo Services

When it pertains to the ins and outs of tax obligations, accounting and also financing, nonetheless, it never harms to have a seasoned expert to look to for support. A growing variety of accounting professionals are also taking treatment of things such as cash circulation projections, invoicing and also HR. Inevitably, most of them are handling CFO-like duties.Small company proprietors can expect their accountants to assist with: Selecting the organization framework that's right for you is vital. It influences just how much you pay in tax obligations, the documentation you need to file and also your individual responsibility. accounting fees If you're looking to transform to a different business structure, it might result in tax repercussions and other issues.

Even companies that are the same dimension and also sector pay very different amounts for audit. These prices do not convert into money, they are needed for running your company.

The Only Guide for Virtual Cfo In Vancouver

The typical price of audit services for small company varies for each and every one-of-a-kind situation. But because bookkeepers do less-involved tasks, their prices are usually cheaper than accountants. Your monetary service fee depends on the work you require to be done. The typical month-to-month audit costs for a local business will certainly rise as you include extra solutions as well as the tasks obtain harder.You can record deals and process pay-roll making use of online software program. Software program services come in all shapes as well as dimensions.

Tax Consultant Vancouver Things To Know Before You Buy

If you're a brand-new organization proprietor, do not neglect to aspect audit costs right into your budget. Management prices and also accounting professional fees aren't the only audit expenditures.Your ability to lead employees, offer consumers, and also make decisions might experience. Your time is likewise useful and also need to be taken into consideration when looking at audit costs. The time invested in accounting jobs does not produce revenue. The much less time you invest in bookkeeping as well as tax obligations, the movie accountant trailer more time you have to grow your service.

This is not view it intended as lawful suggestions; to find out more, please go here..

Some Known Factual Statements About Tax Accountant In Vancouver, Bc

Report this wiki page